Making of MISM

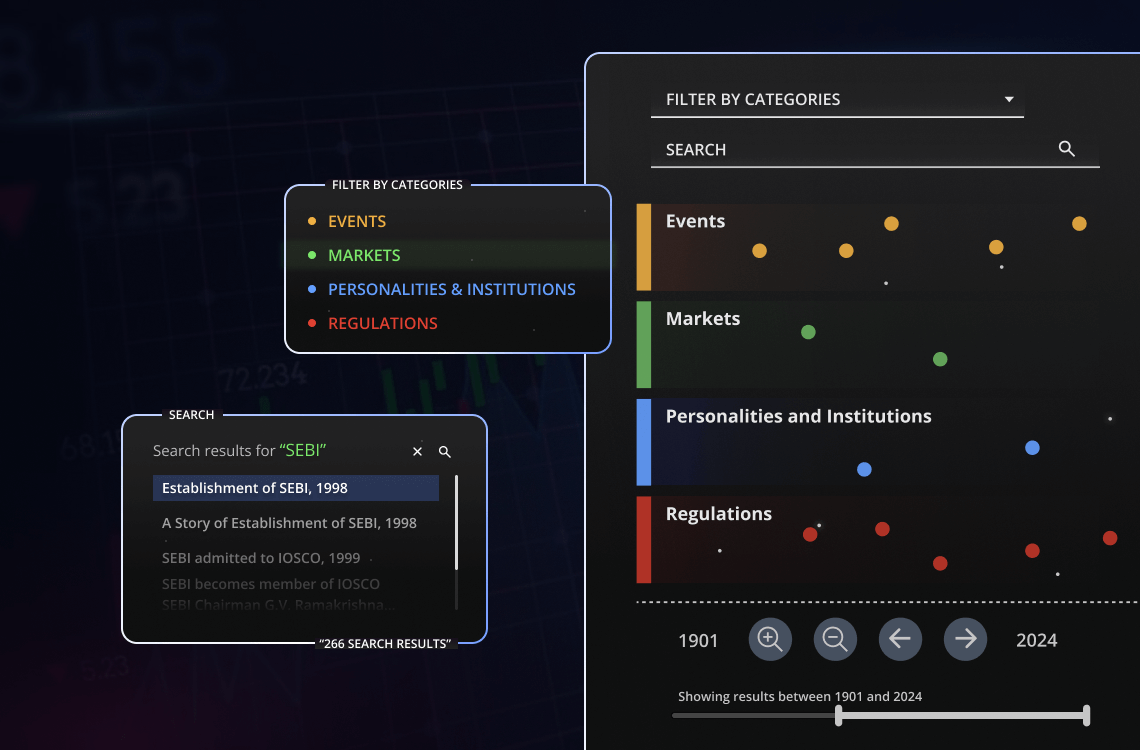

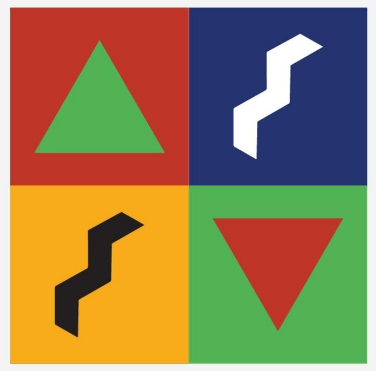

The design draws inspiration from ancient visual scripts, such as Egyptian hieroglyphs, highlighting the efficiency of simplicity and the use of geometric forms as foundational elements. The isometric view further an architectural approach of understanding growth and MISM's vision of creating a common space for its diverse audience.

Watch Video

Mission

MISM intends to preserve, document and exhibit tangible and intangible heritage of Indian securities markets for the purposes of education, awareness, research and knowledge among general public, researchers, students etc.

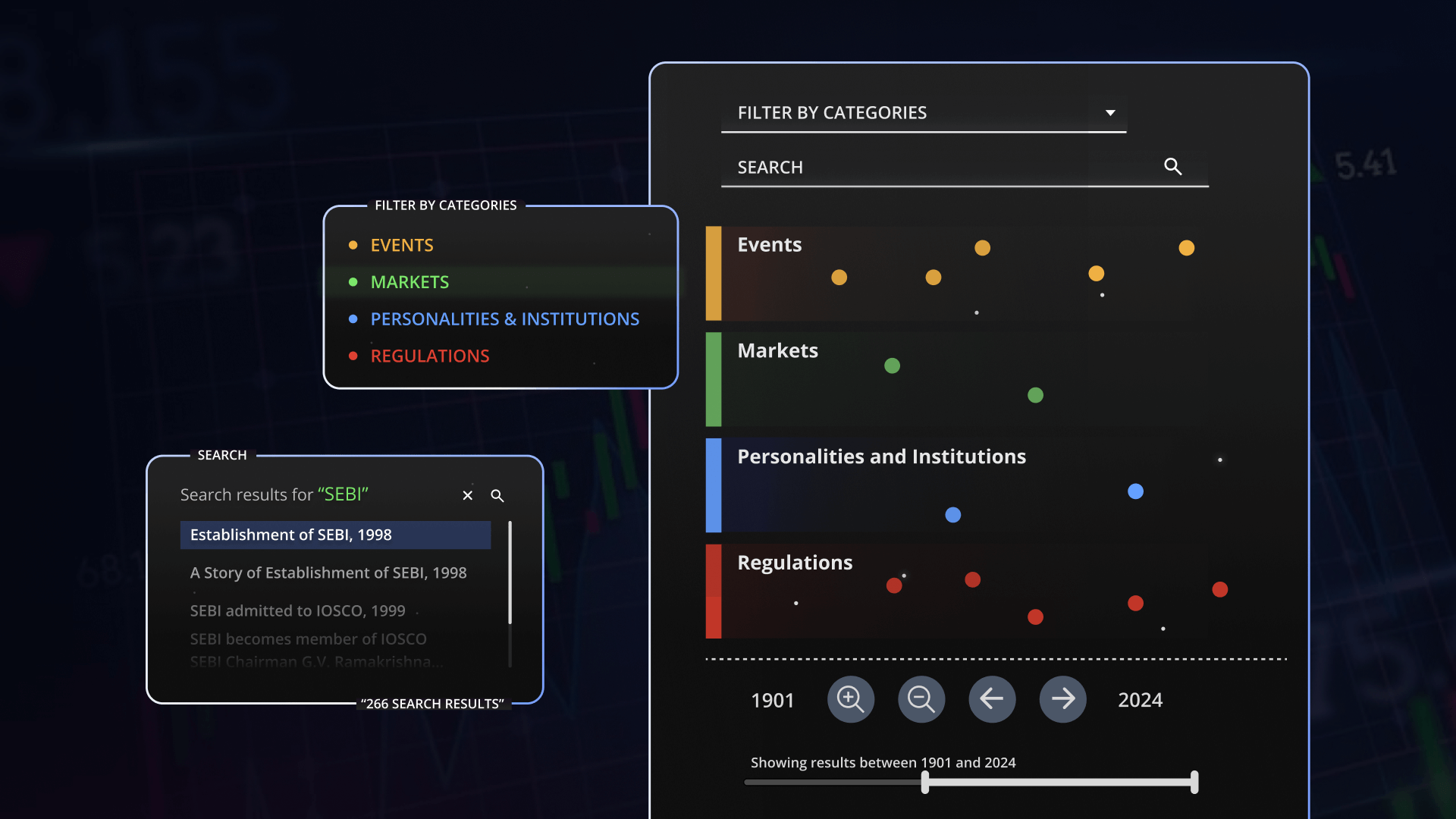

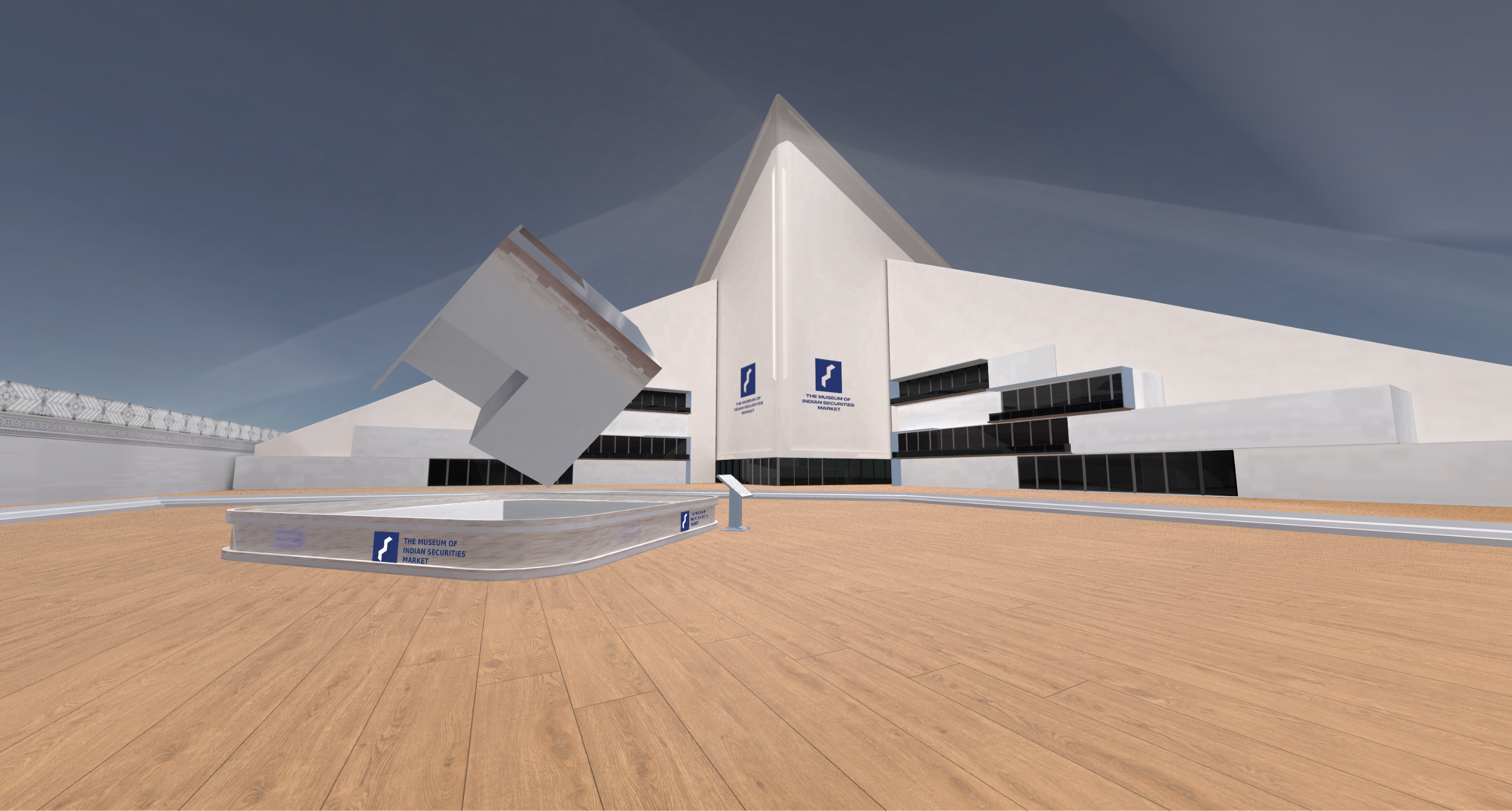

Virtual Environment

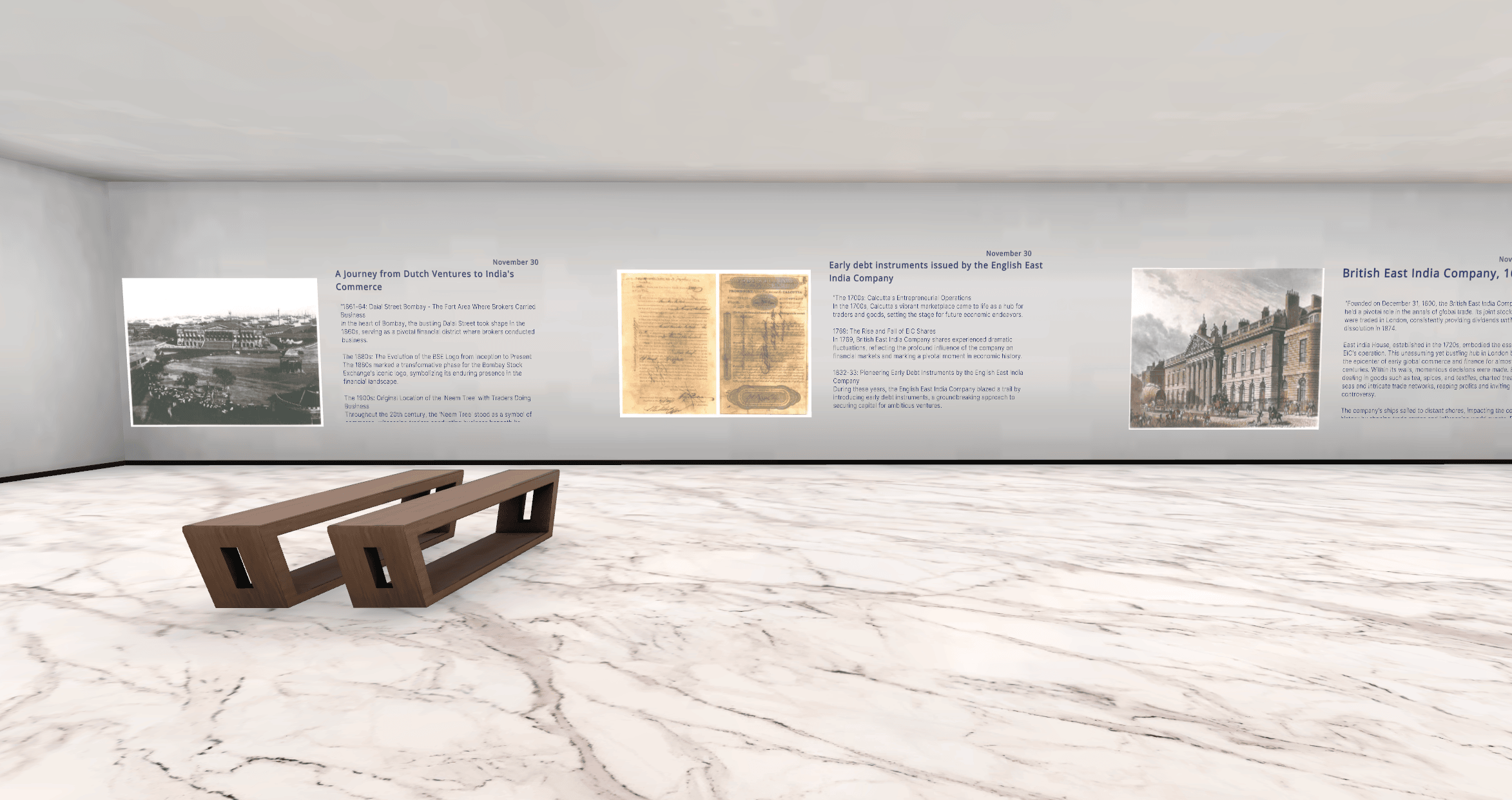

MISM as a virtual museum with no physical presence has undertaken to extend the ethics embedded in its design principles throughout its virtual presence. The two-dimensionality of the logo design is realised through an exclusively designed architecture and customised environment.

The environment is planned in two wings. Accessible from a central menu, one wing focuses on the evolution of trading and modern governance. While the other wing explores and highlights personalities, material memory like old share certificates, and offers further interaction with multiple puzzles and quizzes to test one's learning.

MISM traces the interesting trading traditions of ancient India bringing life to centuries of trading tales and regulatory practices. It offers a digital journey through galleries informing about the market structures, events and their impact in its evolution.

About SEBI

The Securities and Exchange Board of India (SEBI) was constituted as a non-statutory body on April 12, 1988 through a resolution of the Government of India. Subsequent, SEBI was established as a statutory body in the year 1992 and the provisions of the Securities and Exchange Board of India Act, 1992 (15 of 1992) came into force on January 30, 1992.The Preamble of SEBI describes the basic functions of the Securities and Exchange Board of India as "...to protect the interests of investors in securities and to promote the development of, and to regulate the securities market and for matters connected therewith or incidental thereto"On April 12, 2024 SEBI turned 36. As we look back to the years gone by, we see 35 years of continuous, collaborative efforts at nurturing a securities market ecosystem which strives to facilitate cost effective, transparent and sustainable capital formation for the country.